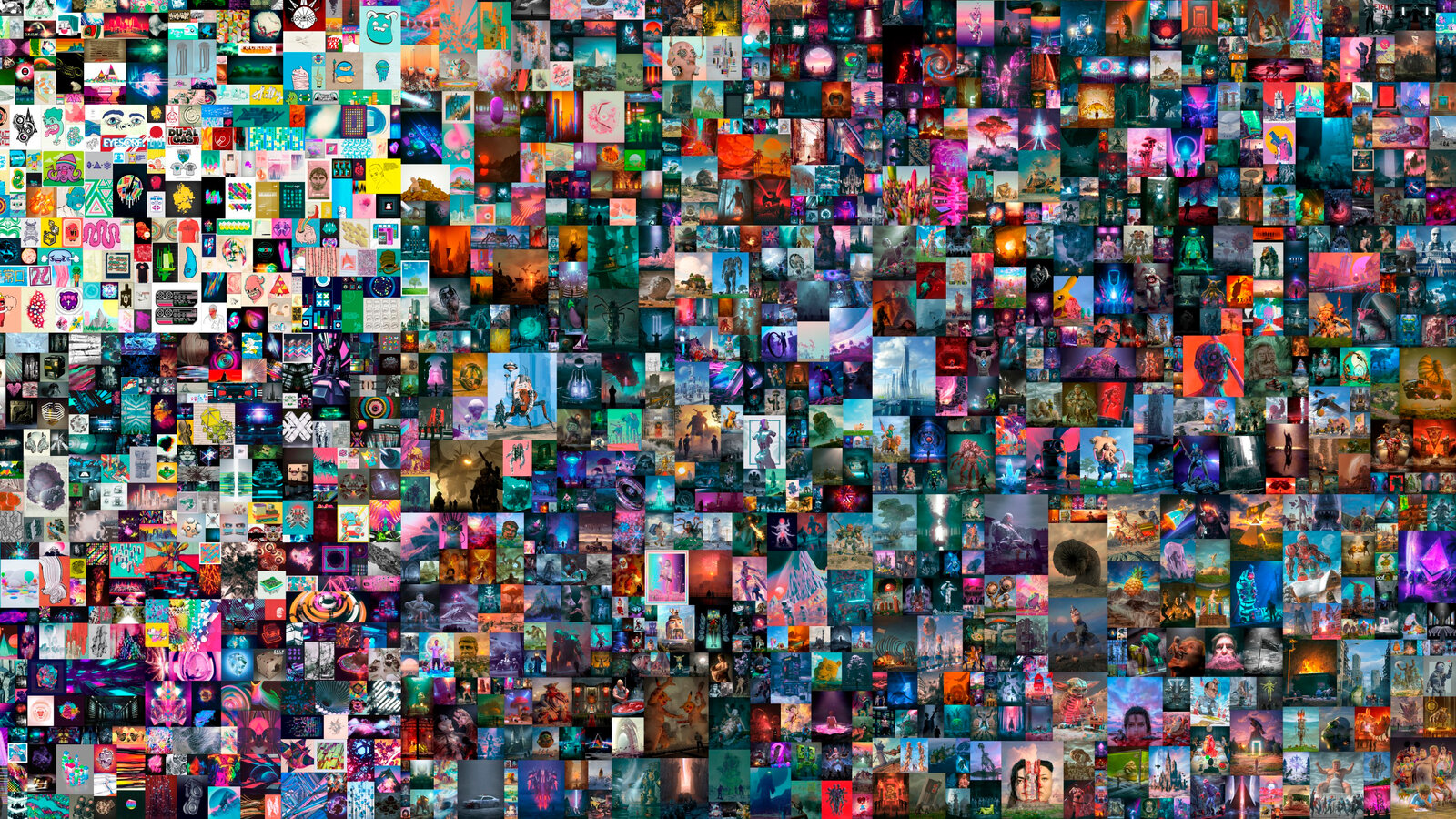

This tweet, the first ever tweet by the CEO of Twitter, Jack Dorsey, sold for nearly USD 3 Million in April 2021.

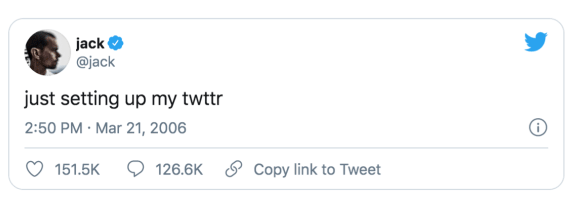

This jpeg made by a digital artist, Beeple, sold for USD 69 Million in March 2021.

The tweet and the jpeg are both NFTs. Why would you pay for an NFT when you can look at it for free?

Well, I’m glad you asked, because I too have been trying to wrap my head around NFTs and why these have become so popular in the past year, specially amongst digital artists and other content creators who now consider it as an alternative sourse of revenue generation.

Breaking down the jargon will help us unravel NFTs better. NFT stands for non-fungible token. So lets start with understanding the difference between fungible and non-fungible items. Fungible items are interchangable, which means if you trade a currency note of INR 100 for another INR 100 or two currency notes of INR 50, you’ll have exactly the same thing. The value associated with a INR 100 currency note is the same as the value associated with another INR 100 currency note, or two INR 50 currency notes or five INR 20 currency notes. Alternatively, non-fungible items are one of a kind and can’t be replaced with other items. The value associated with a non-fungible item is usually limited to the item itself, in it’s purest form. For instance, if you own a specially unique trading card (which holds value due to it’s rarity), you’d not want to trade it for a card that isn’t as or more valuable than the card you own.

The word token is associated with blockchain. A very surface level explanantion would be to treat the blockchain as a massive ledger which includes meticulous records of several transations or tokens maintained and verified publicly by all of its users. Now, lets say our good friend Alice from Wonderland wants to buy and own a picture of the Mad Hatter within the blockchain, how would she do it? Well, firstly all of the users within the blockchain need to determine what the price of the Mad Hatter jpeg is and verify whether Alice has enough bitcoins to pay for it. Lets say the price of buying and owning one jpeg of the Mad Hatter is 2 BTC. So now all Alice has to do is to pay 2 BTC to the person selling the Mad Hatter jpeg and through a public verification and the generation of a unique hash value associated with the jpeg, the jpeg will now be owned by Alice.

So, a non-fungible token is basically a digital asset who’s ownership is verified through blockchain technology. This digital asset could be in the form of an image, a video, a tweet, a code, music and the list just goes on and on. The hash value of this digital asset within the blockchain is what makes the asset unique and verifiable. Most NFTs are stored on a blockchain called Ethereum. That’s why alot of NFTs are sold in Ether or ETH.

The lure of owning an NFT is basically equivalent to the lure of owning an original piece of art or something extremely rare. And this rarity or uniqueness of said item is what makes it highly valuable.

And that is why there are NFT buyers fall broadly under two categories, one is just an enthusiast or collector and the other is an investor. So, the collector, as the name suggests, is someone who is fond of collecting beautiful and rare pieces of art, whereas an investor is some who is hoping for the value of said pieces of art to go up in the near future, which would help said investor make a significant return. There’s also a third category of buyers emerging owing to NFT’s popularity on platforms like YouTube and TikTok, which is fans! Fans who want to take the opportunity to support their favourite content creators. Yep, Logan Paul, one of the OG YouTubers sold his NFTs, which were just a jpeg images of himself in a Pokemon style card for USD 5 Million in a day! Since Logan Paul has a huge following on YouTube, his fans swooped in to buy his NFT as soon as he announced that it was available for sale.

Logan’s success within the NFT space pushed other YouTubers to make and sell their own NFTs to their subscribers. NFTs are now an additional means to monetise a following. Colin and Samir, who host an excellent podcast aimed at the creator economy, created their own NFT and have gone into detail about how the went about doing it in this video. I highly recommend watching it if you potentially want to create one. I haven’t bought or created an NFT myself, but I’m keen to learn more about this alternate form of investing. More to come in future posts as I dig into this further.